The steps in the correct computation of SSS Maternity Benefit are made simpler here. The government has its own way of providing benefits to its people, especially to the needy. One of the widely used is SSS Maternity benefits, where women who gave birth or experienced miscarriage are provided cash assistance.

It is equivalent to the member’s daily rate times 60 days for normal delivery and miscarriage and 78 days for Caesarean. Here are the qualifiers for this benefit.

- The claimant has settled at least three contributions in 12-month period before delivery or miscarriage.

- The claimant has provided prior notification to her employer or to SSS.

Here is the step by step processes on how you may compute your SSS Maternity Benefit accurately.

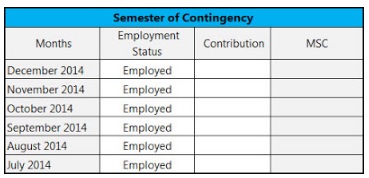

- Do not count the first 6 month period of your pregnancy or prior to your miscarriage. This is the time where SSS evaluates your eligibility to receive such benefit.

- Determine the 12th month from the semester you determined from Step 1 backward and select the 6 highest monthly salaries in those 12 months.

- Get the sum of those 6 highest monthly salaries.

- Divide the sum from Step 3 to 180 days to determine your daily maternity benefit.

- Multiply the answer from Step 4 to 60 days (normal or miscarriage) or 78 (Caesarean).

Read Also:

If you are still confused, you may refer to the sample contributions below. The employee is cited to have 581.30 pesos monthly contribution for 2014 and 500 pesos for 2013.

The 6 highest monthly salaries are amounting to 16, 000, so if the amount is multiplied to 6, it equals to 96, 000. We need to divide it to 180. The answer should be multiplied to 60 or 78.

- 32, 000 for normal or miscarriage

- 41, 600 for Caesarean

For other instances, you may check the hyperlink provided above, check the SSS website, or call their hotline at (02) 920 6455.