Pag-IBIG members, take note. The Home Development Mutual Fund (HDMF) has released a new Contribution Table for 2017. If you are aiming to avail of housing loans or other loans offered by Pag-IBIG, then you need to pay full attention here.

Whether you are an employee, employer, or OFW, you should be aware of this new Contribution Table so that you are aware about the amount you should be contributing each month.

Pag-IBIG Contribution Table 2017

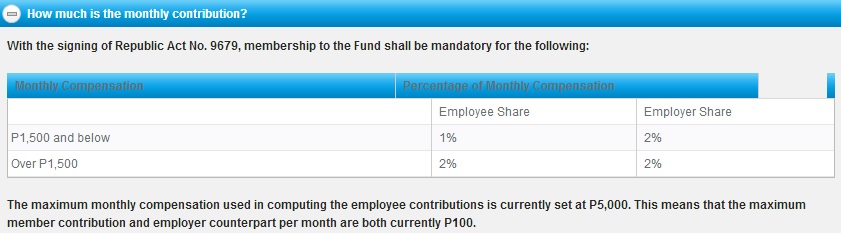

So how does one compute their monthly Pag-IBIG contributions?

For starters, you should keep in mind that the maximum monthly compensation permitted to compute each employee’s Pagibig contribution is currently set at P5,000. What this means is that the maximum contribution a member can pay every month is currently P100 while the employer’s share is exactly the same amount – P100.

So if you are an employee and are receiving a salary of more than P5,000 per month, an amount of P100 will be automatically deducted from your wage each month as your contribution to Pag-IBIG. Your employer, on the other hand, is also obligated to pay his or her share of P100 on your behalf, making it a total of P200 per month.

READ ALSO :

How does Pag-IBIG earn money?

To give you an idea, Pag-IBIG or HDMF is a mutual fund and so all the money contributed by the members are pooled and invested to various financial instruments, composing mostly of government funds or money markets.

See also: The Updated Monthly Amortization Table of Pag-IBIG Housing Loan for 2018

For more information about the new Pag-IBIG Contribution Table, you can check out the official Pag-IBIG website or you may also pay a personal visit in their offices located near your area.

Also, keep visiting our Pinoy Juander website and we will keep you updated about much useful information.